is idaho tax friendly to retirees

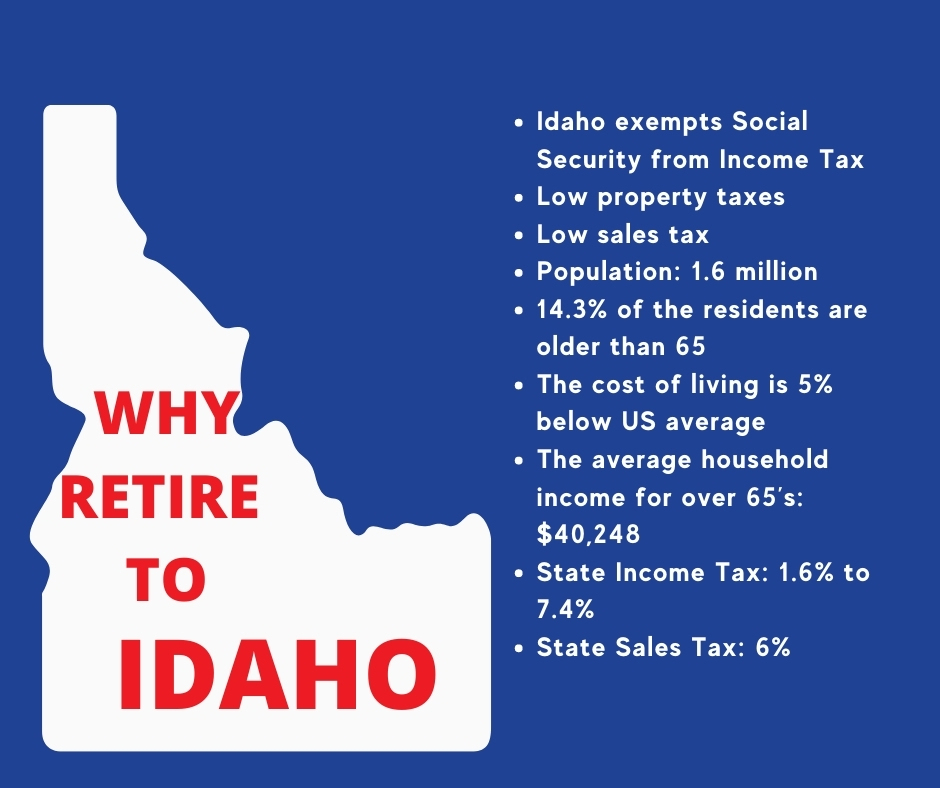

Idaho is tax-friendly toward retirees. Part 1 Age Disability and Filing.

Recipients must be at least age 65 or be.

. Withdrawals from retirement accounts are fully taxed. In Idaho the median property tax rate is 659 per 100000 of assessed home value. Contents1 What are the benefits of.

Retirement income exclusion from 35000 to 65000. Social Security income is not taxedWages are taxed at normal rates and your marginal state tax rate is 590. Withdrawals from retirement accounts are fully taxed.

Social Security income is not taxed. This guide lists some resources that can be useful to Idaho senior citizens and retirees. There is no state income.

Idaho is tax-friendly toward retirees. Withdrawals from retirement accounts are fully taxed. Withdrawals from retirement accounts are fully taxed.

Social Security income is not taxed. Idaho residents must pay tax on their total income including income. Permanently exempted groceries from the state sales tax in 2022.

Idaho is tax-friendly toward retirees. Idaho is tax-friendly toward retirees. Established a 39 flat income tax rate and eliminated state tax on retirement income in 2022.

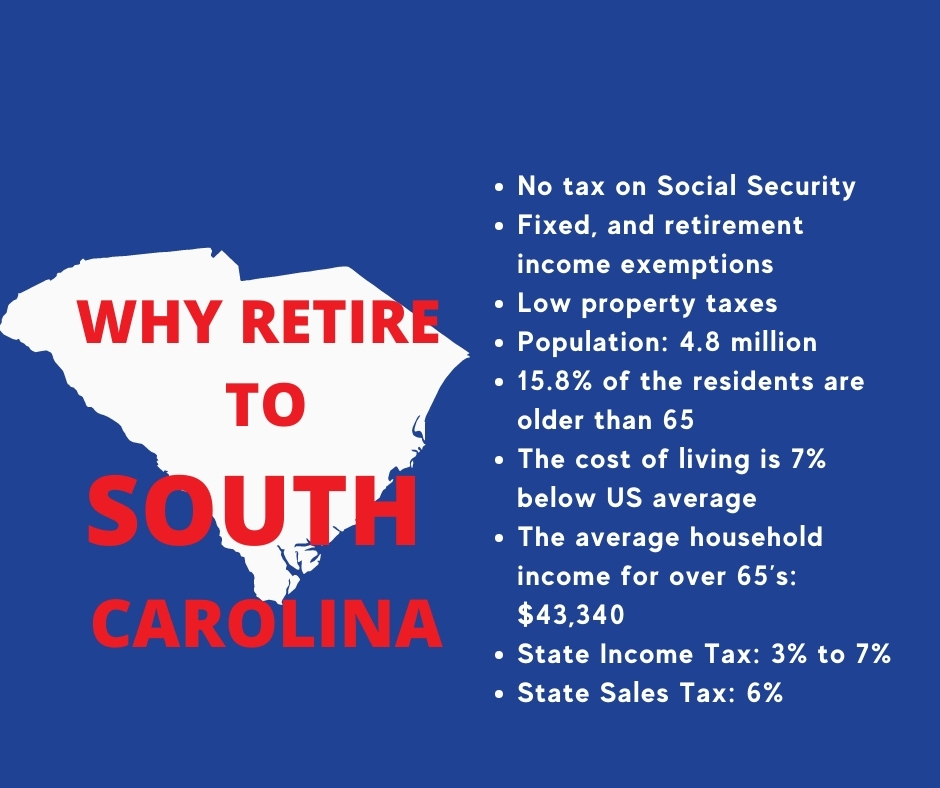

Idaho property tax breaks for retirees for 2022 homeowners age 65 or older with income of 32230 or less are eligible for a property tax. State sales and average local tax. Retirees benefit from a relatively low property tax and no tax on Social Security income in Idaho.

The Idaho Retirement Benefits Deduction may be available to retirees who are both disabled and receive a qualifying source of retirement income. Idaho is a great place to retire for many reasons but one of the biggest is the states tax laws. Public and private pension.

Idaho is tax-friendly toward retirees. How can I avoid paying tax on my pension. Idaho Real Property Taxes.

Social Security income is not taxed. Idaho Property Tax Breaks for Retirees. 404-417-6501 or 877-423-6177 or dorgeorgiagovtaxes.

Wages are taxed at normal rates and. 800-352-3671 or 850-488-6800 or. Is Idaho Tax Friendly To Retirees.

Wages are taxed at normal rates and. Social Security income is not taxed. Idaho is one of the most tax-friendly states in the country for retirees.

Is Idaho Tax Friendly To Retirees. Idaho allows for a subtraction of retirement income on your state return if the taxpayer meets both parts of the two-part qualification that the state requires. Idaho property tax breaks for retirees for 2022 homeowners age 65 or older with income of 32230 or less are eligible for a property tax.

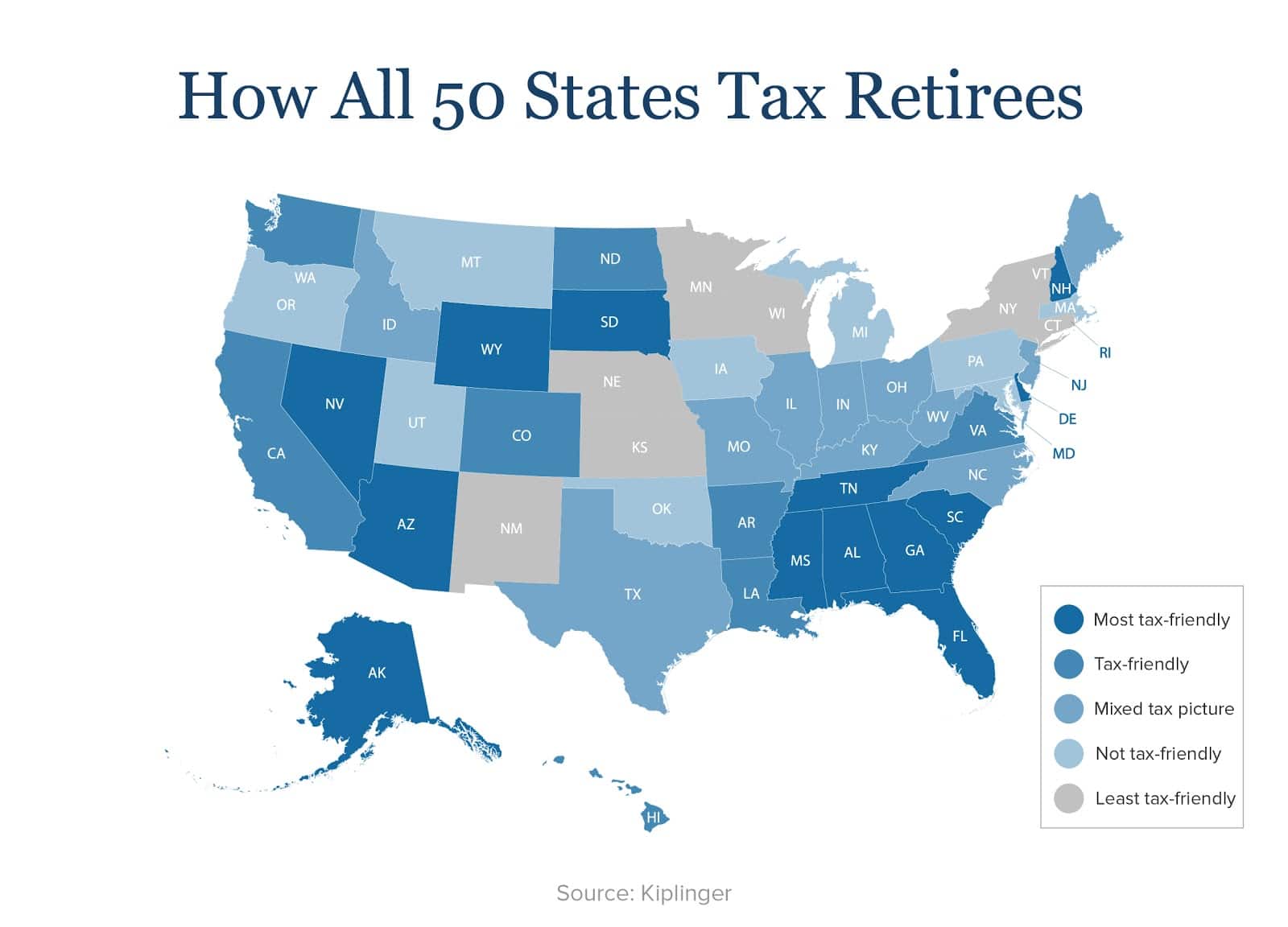

Best And Worst States For Retirement Retirement Living

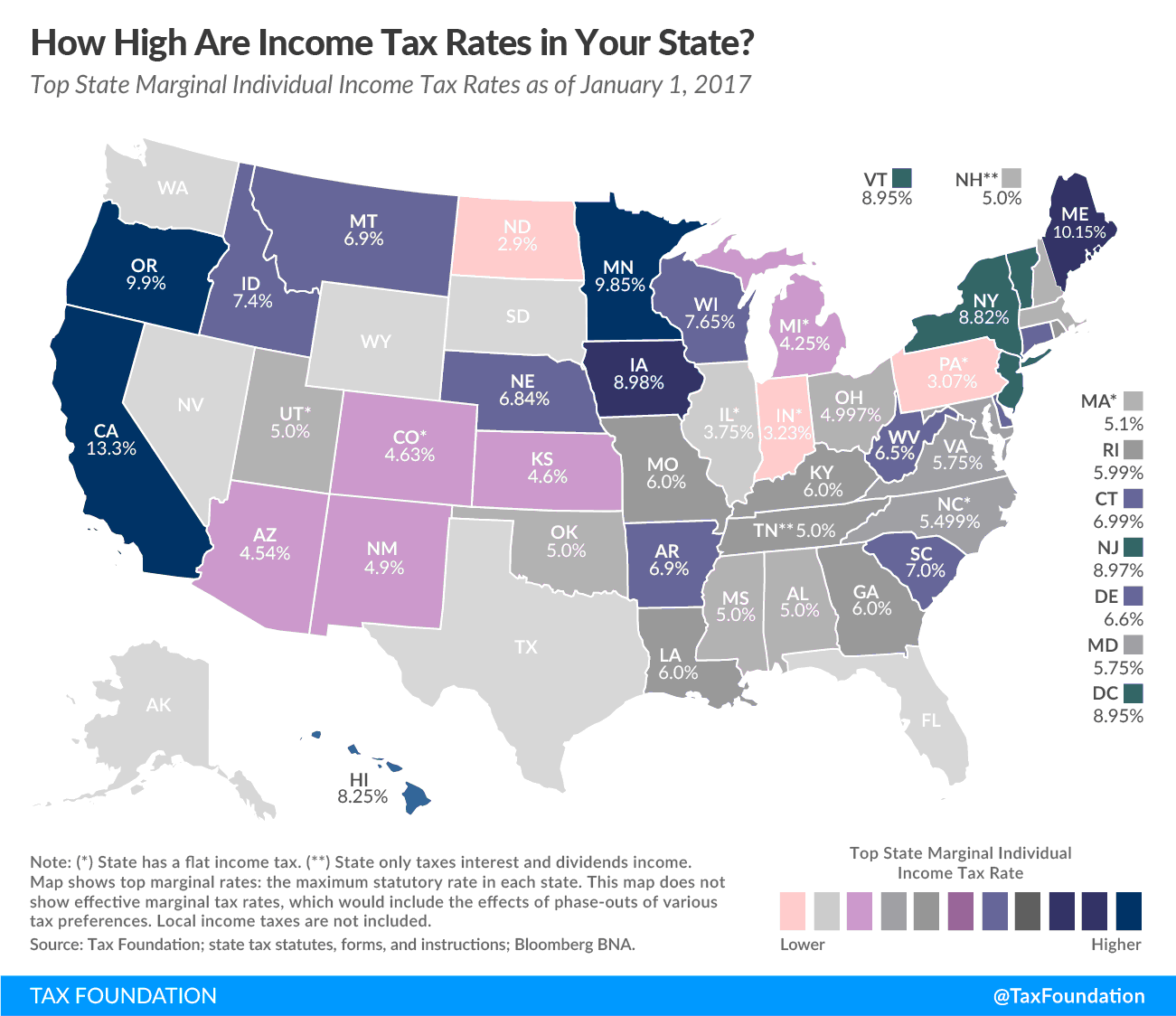

Surprising Data Reveals The Top 25 Tax Friendly States To Retire

37 States That Don T Tax Social Security Benefits

10 Affordable Small Towns In Tax Friendly States Retirement Benefitspro

Idaho Retirement Taxes And Economic Factors To Consider

The 10 Best Places To Retire In Idaho In 2021 Newhomesource

21 Pros And Cons Of Retiring In Idaho Retirepedia Articles Advice For A Beautiful Retirement

Top 5 Best Places To Retire In Idaho Nowhere Diary Youtube

Military Retirement And State Income Tax Military Com

The Numbers Who Gets Rebates Tax Cuts Under House Bill Local News Idahopress Com

7 States That Do Not Tax Retirement Income

The Most Tax Friendly States To Retire

Idaho Retirement Tax Friendliness Smartasset

Tax Friendly States That Don T Tax Pensions Or Social Security Sofi

Top 10 Best States To Retire In 2022 Retirebetternow Com

How To Plan For Taxes In Retirement Goodlife Home Loans

Surprising Data Reveals The Top 25 Tax Friendly States To Retire